The 449 companies in the S&P 500 index that were publicly listed from 2003 through 2012. It wasn’t until 2014, when University of Massachusetts economist William Lazonick published a report in the Harvard Business Review documenting the practice, that it began to come to public notice. It took some time for CEOs to realize that this method of self-enrichment had been opened to them. In that year, Ronald Reagan’s appointees to the SEC passed a new rule legalizing the practice. Until 1982, buying back shares wasn’t actually allowed. The Journal reports that they’re on track to buy back at least as much this year. Last year, companies listed in the Russell 3000 announced they were buying back a cool $1.27 trillion of their own shares, which was an all-time record. Merely to lay out that process is to explain why it continues to grow. It means that CEOs are buying back their own companies’ shares, which, by reducing the number of shares outstanding, raises the value of those shares, which benefits many of those same CEOs, who get bonuses when the companies’ share values rise, and the bulk of whose compensation comes in the form of awarded shares, too. The S&P 500’s 8 percent increase this year, then, doesn’t mean that mom and pop, or even mom and pop’s pension fund, are flocking to the market. The only reason stock prices have risen at all is reflected in the bank’s findings about two other groups of its clients: hedge funds, which have purchased about $4 billion more than they’ve sold, and corporations, which have bought back roughly $30 billion of their own shares.

Tap forms harvard full#

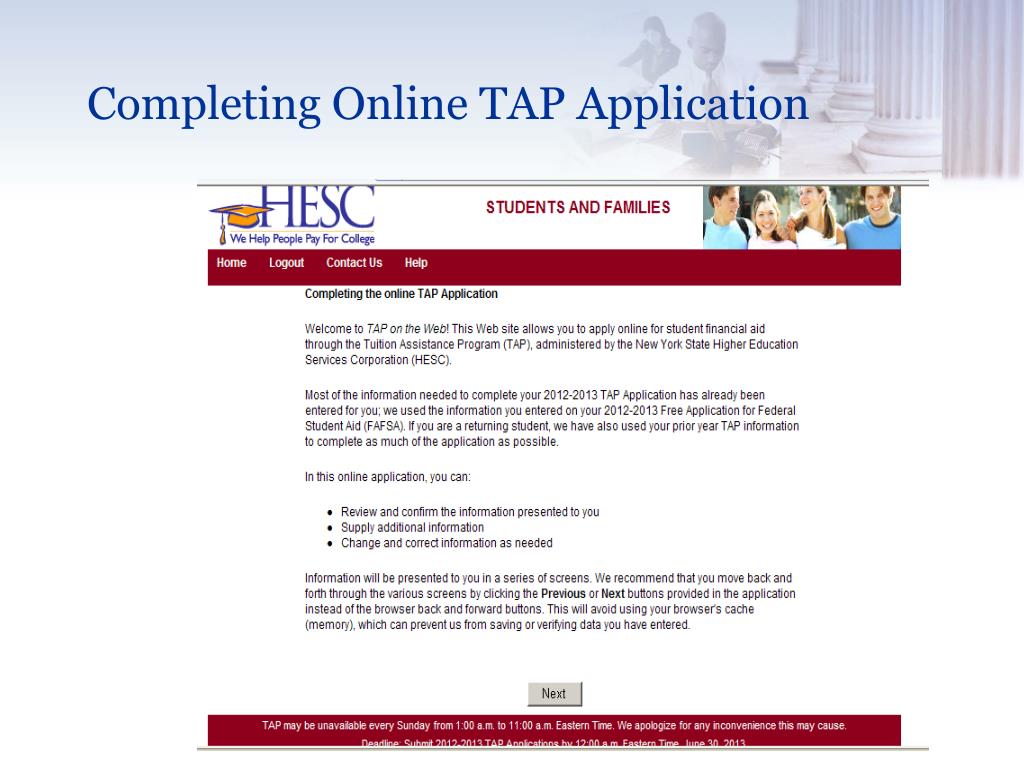

Please refer to the TAP/TRP booklet for the full rules and eligibility.The American economy has reached the point where rising stock prices don’t actually reflect people themselves buying stock.Īs a recent report in The Wall Street Journal documented, a Bank of America survey of its individual and institutional investor clients reveals that they have been selling off more shares than they’ve been buying since the start of the year, to the tune of $25.3 billion. You can learn more in the Questions and Answers Regarding TAP Process Change.

Employees may designate a course as job-related when enrolling using a graduate-credit TAP form, by describing the job-related education that will be provided the completed form must be approved by the supervisor/manager by the semester's TAP form deadline. TAP benefits are not taxable if a course is job-related per the IRS standard. In such cases, amounts above $5,250 will be reported as income to the employee on the W-2 and the University will withhold taxes on this amount from employee’s pay (employees may choose to pay the full amount of taxes to Harvard Payroll in lieu of withholding). The total tuition benefits for such courses during a calendar year exceeds $5,250. Not related to your current job duties (per the IRS standard) and.Taken for graduate credit (courses taken for undergraduate credit or for no credit are not taxable) Per IRS standards, TAP benefits for courses that meet all three criteria below will be treated as taxable income:

TAP Administration Process and Taxes for Graduate Courses TAP forms and manager/supervisor approval for summer 2022 graduate-credit courses that meet the IRS standard of job-relatedness must be submitted no later than July 15, 2022.

0 kommentar(er)

0 kommentar(er)